by it | May 3, 2021 | Uncategorised

Net income and gross profit are both components of an income statement that demonstrate the profitability of a company—but they do so through different lenses. The Basics Net income is a company’s total profits after subtracting the cost of all of its expenses from...

by it | May 3, 2021 | Uncategorised

Understanding capital is essential to starting, growing, or evaluating a business of any size. What is capital? Nic Barnhart of Pareto Labs defines capital as simply, “Money that is used to make more money.” This definition can apply to individuals in the greater...

by it | May 3, 2021 | Uncategorised

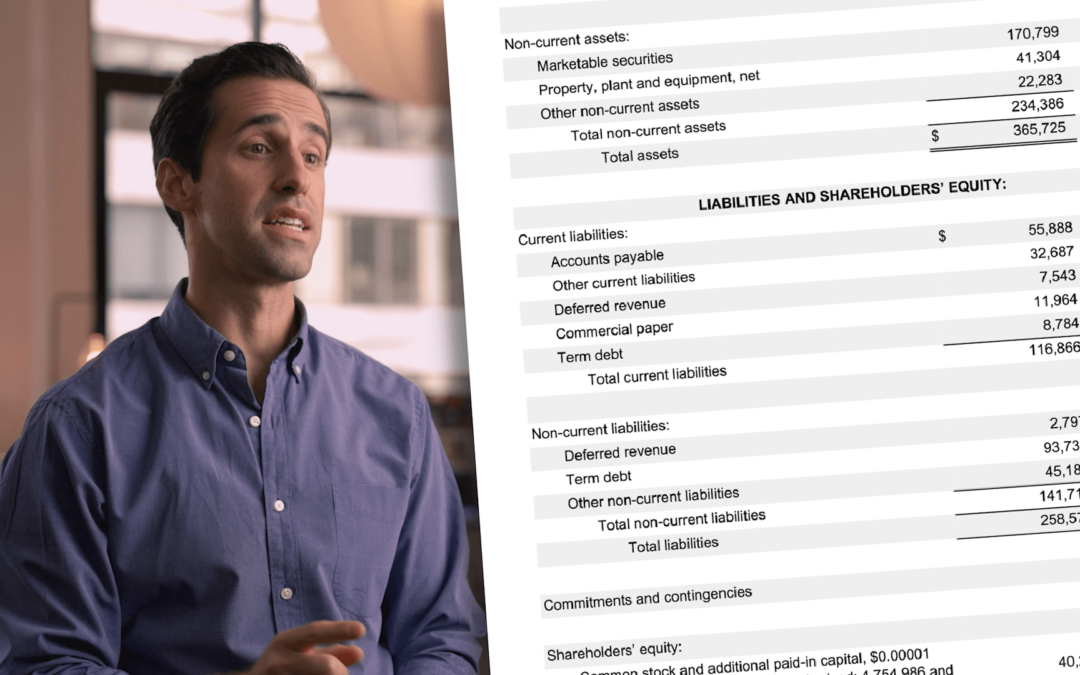

The Basics Deferred revenue refers to payment received in advance of a business delivering a product or service. A company will record deferred revenue first as a liability on the balance sheet, then—after goods or services have been delivered—as earned revenue on the...

by it | Apr 23, 2021 | Uncategorised

The Basics “Accounts payable” (AP) refers to a company’s short-term debt to its vendors. The term also refers to the AP department that handles the accounts payable process. Accounts payable appears as a liability account on the balance sheet, the associated expense...

by it | Apr 23, 2021 | Uncategorised

The Basics “Accounts receivable” (AR) refers to the short-term debts that customers owe a company for goods and services. Along with accounts payable, accounts receivable can have a significant impact on a company’s cash flow and overall health. It’s important to...